TradeCloud Commodities Web Services AG.

Incorporated in Switzerland +41 413 780 326

Company Number: CHE453.673.398

Founded by a group of leading Commodity and IT professionals with proven track records of success, TradeCloud is a bespoke platform, designed and developed specifically for the physical commodity markets.

TradeCloud’s vision is to bring the commodity industry into the digital age, by providing it with a state-of-the-art communications platform and the realisation of The Commodities Web -

a network-of networks of services, built around blockchain technology.

Live for just one year, TradeCloud has attracted over 240 enterprises and 500 users onto its platform. With customers in over 39 countries, some of the largest global producers and consumers have signed up to join our growing community. Over USD 1 billion of physical commodity trades have already been initiated on

the platform and the volume is accelerating.

TradeCloud currently serves the metals industry and plans to expand into the energy and agricultural sectors in the near future. The combined trade value across the three markets is estimated to be in excess of USD 8 trillion per year- representing one, if not the, largest untapped e-commerce opportunity available today.

We intend to raise up to US Dollars 42 million via TC Tokens which will be issued through a Swiss subsidiary.

TC Tokens will be convertible into internal payment units via a smart contract.

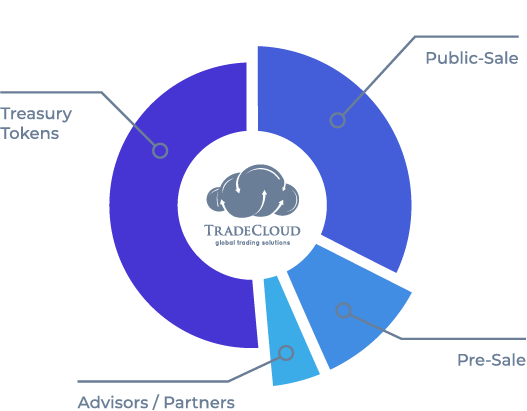

The TC Tokens will be distributed approximately as follows:

The funds raised will be used to accelerate the growth of TradeCloud. The TradeCloud management team expects the funds to be applied in the following manner.

Unlike many other Technology start-ups, TradeCloud has been funded by its Founders. This has led to a strict budgetary process and all expenditure has only been made after rigorous cost/benefit analysis. This discipline will continue going forwards.

Based on the current budget, it is anticipated that a successful STO will raise enough funds to allow TradeCloud to aggressively develop and promote the product for at least the next three years, irrespective of revenue. This gives the company sufficient head room to grow in the most logical way.

The commodity industry has been slow to change. Market participants and service providers remain disconnected, only being able to reach each other through out dated or not-fit for purpose communication tools. This has led to inefficient communication, inadequate price discovery and a poor allocation of services to the industry.

The lack of digitalization in this space has contributed to fraud, sometimes on an enormous scale such as Quingdao ( pop up ) and emailed payment instructions being intercepted and changed. Services such as new finance channels and credit insurance capacity have not been able to be accessed and utilized as the providers and those that need their services have not been connected. Inefficient processes and antiquated price discovery methods have caused rising costs and shrinking margins.

TradeCloud is already building communities and connecting the industry over it’s secure, efficient and easy to use platform. Our digital vision, centred around the Corda blockchain will make transacting and executing physical commodity trades, fast, efficient, secure, both reducing costs and improving margins at the same time.

Platform build

starts

STO project started

Pre-Sale process

starts

Regulatory

Clearance

obtained for STO

Public sale

TradeCloud

established

Platform

goes live

$500,000M of

transactions initiated

on TradeCloud.

200 customers,

36 countries

$1Bn of

transactions

initiated on

TradeCloud.

245 customers,

39 countries

Private sale

TradeCloud has been founded by a group of leading professionals with strong experience in the commodities and technology space. We are passionate in our drive to take the physical commodity business into the future.

Established in 2000 and located in Zurich, CMP are experienced operators in the Crypto space, providing asset management, fiduciary business and crypto advise in addition to the role they will perform for TradeCloud.

Inacta, located in Zug have developed an integrated blockchain solution to seamlessly and securely onboard investors, allow KYC and AML checks to be performed efficiently and generate tokens.

Mattia combines an advanced exposure to blockchain technology and applications, crypto finance and crypto regulation, with 25-year experience in the financial industry, in senior risk, compliance, audit and governance positions - of which 18 years at UBS, including as Head Group Regulatory Relations and as Advisor Group Regulatory Strategy for 10 years. He is Chairman of the working group Policy & Regulation at the Crypto Valley Association and advisor to selected crypto companies.

Intrum is Europe’s undisputed, leading credit management company. Intrum will use state of the art “id now” software to ensure the identity of our investors.

Volo, TradeCloud’s software-development partner, has the ability to apply innovative solutions to the most challenging enterprise software, mobile and internet-of-things projects.

R3 have developed Corda, an open-source enterprise blockchain from R3. It has a strong focus on features such as performance, documentation and management that make it work in an enterprise environment.

Microsoft Azure supports many different programming languages, tools and frameworks including Microsoft-specific and third-party systems and software.

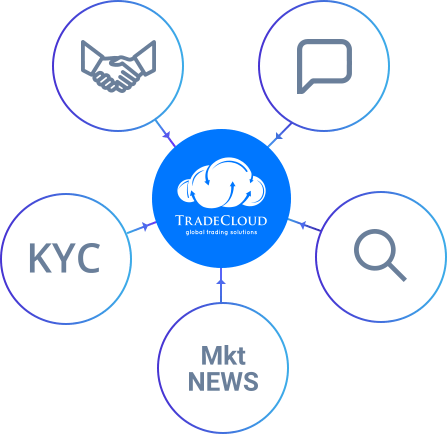

TradeCloud is an online platform where producers, consumers and traders of physical commodities can meet to exchange information, negotiate contracts and conclude business.

TradeCloud was founded by three commodity executives and one technology expert. The Founders have a combined experience in their respective field of over 100 years. The Founders are high profile individual in the commodities trading and finance area with a proven track record in building business and delivering consistent profits over the long-term.

TradeCloud has been funded 100% by its Founders who have invested millions of dollars in the building launch and marketing of the platform. This has led to a strict budgetary process and all expenditure has only been made after rigorous cost/benefit analysis.

TradeCloud has been Live for over 12 months. It is available on desktop and mobile applications. It is fully functioning with over 240 customers and 500 users. TradeCloud is Live in over 39 countries reflecting the global nature of TradeCloud’s business.

Enormous. TradeCloud currently covers nonferrous metals which is a half a trillion dollars market on its own. Funding from the STO will allow TradeCloud to move into oil and agricultural products which are markets of $5.4 trillion and $1.9 trillion respectively. In our opinion, commodity trading is the largest untapped E-Commerce market existing today.

Per annum.

Private sale June 2019

Public sale July-November 2019

50% treasury not earlier than Q12020

A hard cap of US $42 million tokens equivalent will be issued benefiting from a material share in the net profit of TradeCloud as well as their utility value.

There will be a soft cap of US $5 million tokens equivalent.

The nominal price of each token is One US Dollar. Investors in the Private Sale will receive a 25% bonus allocation and the Public-Sale a 10% bonus allocation.

The minimum investment amount in the Private Sale is US Dollars 25,000. The minimum investment amount in the Public-Sale is US Dollars 10,000.

Apart from the utility value of the tokens, TradeCloud will commit to paying 10% per year of its net annual profit. This is divided across the 50 million of tokens. This will be for a period of 10 years from token issuance. All profit share will be split pro-rata per token. This will be credited via an airdrop to the token holder in ETH.

*If tokens are exchanged for utility they will no longer have profit share rights.

The tokens have both security and utility rights, which are mutually exclusive. TradeCloud customers will be able to exchange tokens for services on the TradeCloud platform. These are services such a trading, price data, financing, logistics and insurance. A token holder will be entitled to share in the profitability of the TradeCloud platform.

Our smart contract was audited by DataArt. This is a leading specialist in IT solutions and cyber security.

www.dataart.com

We are open to crypto investors, private investors, investment funds, and family offices. All investors will need to pass standard KYC and AML checks.

Due to regulatory and political factors, and to comply with international sanctions, we cannot accept funds from individuals or companies which are citizens of, or resident of, or domiciled in the USA, China and in countries part of the following lists:

www.treasury.gov,

www.europa.eu,

www.seco.admin.ch.

TradeCloud will accept EUR, CHF, BTC, and ETH.

The TradeCloud token will be issued under Swiss law.

If you are interested in participating in our STO and would like to receive the full White Paper, please contact us below.

The purpose of this web site is to introduce the Trade Cloud Security Token Offering Project, its story, the problem it identifies and the solution it provides, the intended metrics, the project roadmap and team. The information set forth in this website may not be exhaustive, may be subject to change and does not imply any elements of a contractual relationship, nor does it constitute an offer to sell or a solicitation of an offer to buy a security in any jurisdiction. The information presented has not been reviewed or approved by any financial regulatory authority. All relevant information will be contained in the Prospectus.

Please follow us on: